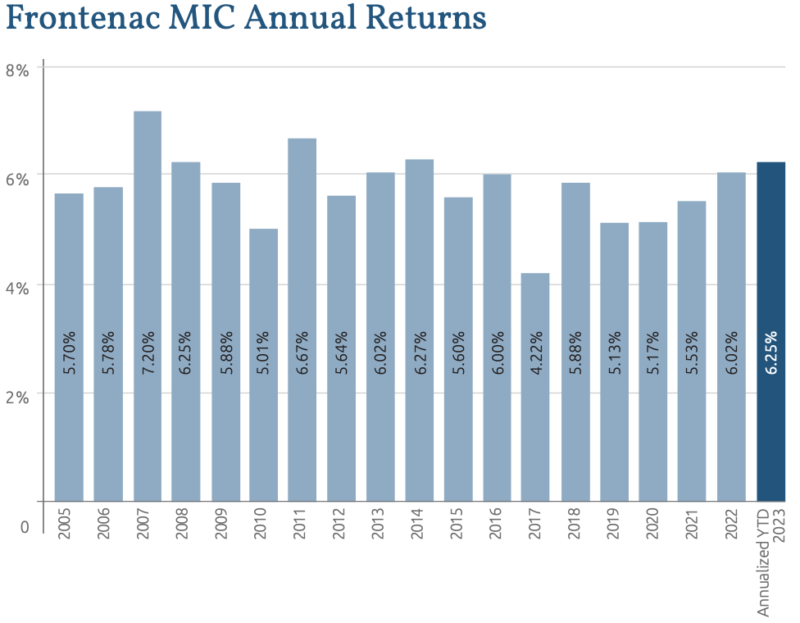

100% of net income distributed monthly

Frontenac offers long-term, reasonable returns on real asset-based investments for those who seek capital preservation. Our value lies in sustainable processes and decisions delivered by an experienced management team.