Frontenac earns income through interest and principal payments, targeting short-term, first mortgages.

The benefit of investing in mortgages is the full transparency of information, including specific payment schedules and collateral details. Mortgages also have specific end dates, so the manager is continuously aware of the exit dates of such investments.

Qualified for RRSP, RRIF, RESP, TFSA, DPSP and RDSP.

Income from a MIC is taxed as interest income making it a good investment for registered accounts.

- Eastern Ontario - 67.1%

- Other - Ontario - 31.5%

- Quebec - 0.0%

- GTA - 1.4%

First mortgage priority means more security.

We are residential real estate experts with an affinity for construction and rural properties. Our team intimately understands these opportunities.

- Residential - 18.8%

- Residential Developments - 5.9%

- Residential Construction - 67.5%

- Vacant Land - 7.8%

- Commercial - 0.2%

Appropriately pricing risk for 40 years.

Targeting a return matching the Schedule A Bank 5-Year GIC plus 3%, Frontenac endeavours to earn a reasonable return while preserving capital.

- Less than 6.49% - 5.1%

- 6.5% to 7.49% - 0.0%

- 7.5% to 8.49% - 3.2%

- 8.5% to 9.49% - 8.3%

- 9.5% to 10.49% - 59.1%

- 10.5% to 11.49% - 10.4%

- 11.5% to 12.49% - 12.9%

- 12.5% to 13.49% - 1.0%

Short-term loans provide pricing control.

The short-term nature of our loans helps to mitigate the interest rate risk that most lenders experience.

- 1 year or less - 97.9%

- Between 1.1 and 2 years - 2.0%

- Over 2.1 years - 0.1%

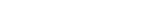

Growth of $100,000 since 2005

Repeatable processes built on a foundation of core principles.

With the more traditional fixed income assets struggling at this time to keep pace with inflation mortgage-based investments have become an excellent alternative for investors who are seeking conservative, consistent and reliable cash flow from their investment portfolio.

The Frontenac MIC is an income producing investment that is well-diversified with real asset security. By investing in the Frontenac MIC you gain access to a pool of 400-500 1st mortgages in the Ontario residential real estate market.

With expertise and experience that has spanned nearly 40 years, we have successfully been providing a 5.0% – 6.5% annual return after fees to our investors from a strategy that is uncorrelated with traditional fixed income or equity markets.

The number of Canadian retirees is expected to increase significantly in the coming years. These retirees and more conservative investors, in general, will be looking for consistent and reliable cash flow to help them enjoy their retirement years. Let’s talk to see if the Frontenac MIC powered by W.A. Robinson Asset Management could be a helpful solution for you.

Service Providers

A corporate culture of trust and care for people.

For 40 years, W.A. Robinson Asset Management has provided financial services from its base in Sharbot Lake, Ontario. Incorporated in 1980, the firm has managed mortgage-based investments since 1983.

Now with about 40 employees, our success is driven by the broad knowledge and expertise of our staff in the areas of mortgage lending, compliance, accounting and marketing. Our team maintains high standards of customer service both in mortgage lending and investment activities.

With a multi-generational vision, our firm remains family owned and is professionally operated.

Frontenac is offered through IIROC advisors across Canada.

The fund is sold on prospectus and offered as common shares in:

- BC, AB, SK, MB, ON, NS, NB, and NL.

- It is sold by OM elsewhere in Canada

It is purchased through FundSERV

- code: WAR 110/111 (F Class)

Frontenac is not traded on the TSX

Historically, Frontenac has been used to complement traditional fixed-income products such as bonds and GICs. Investors can choose between a dividend reinvestment plan (DRIP) or cash for monthly distributions.

We are dedicated to our trusted partners and aim to provide a consistent fixed-income solution.