W.A. Robinson: Important COVID-19 Announcements & Information READ MORE

In a commission-based business like rural and construction lending, the state of the market impacts your bottom line. And it’s no secret that the Bank of Canada’s interest hikes have had a tremendous impact across all markets, affecting the pace and capacity for growth in the short-term.

With all the changes it can be difficult for brokers to provide advice to their clients on whether to buy, renovate, or refinance.

But it’s not all doom and gloom.

Here are 3 key factors that point towards optimism and opportunities in the future.

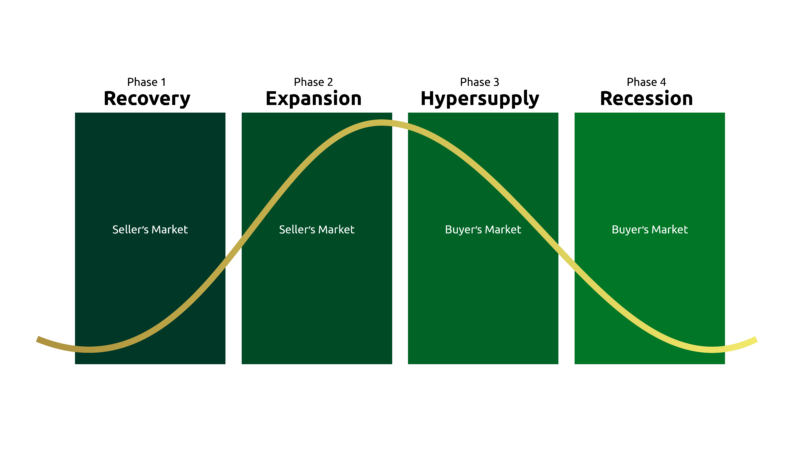

Although the workings of the real estate market are highly nuanced, it has historically been comprised of four main phases: recovery, expansion, hyper supply, and recession.

This implies that no one phase is permanent, and that it is only a matter of time before the Bank of Canada concludes this round of rate tightening and we begin to enter the recovery phase.

While the word recession may carry unfavourable implications, there are opportunities to capitalize in the gaps before an eventual recovery.

It won’t be long before everyone becomes accustomed to higher interest rates, and those who are prepared can identify advantages and opportunities.

The economic makeup of Ontario’s population is a large factor on what drives the market.

While COVID has caused turmoil in many sectors, over the past 5 years employment has remained strong, household income has grown significantly, and many have accrued sizeable savings and home equity.

Moreover, the Canadian economy added 108,000 jobs in October according to Statistics Canada, which is a strong contributing factor to inflationary pressures.

These are all signs that point to prospects down the line, especially considering many Ontarians need homes and there is not enough housing stock.

Another factor we can look to as a sign of things to come is the rate of immigration.

Each year, Canada continues to set historical highs – in 2022 alone the target is 431,000 newcomers, following the entry of about 405,000 the previous year. And that number isn’t getting any smaller. The country is targeting entry of another 900,000 newcomers in 2023 and 2024 combined.

This is incredibly significant for Ontario, as more than half of all new immigrants to Canada choose to settle in the province, increasing the demand for housing in a market that is already at a shortage.

That continued increase in demand is what economists predict will help put a floor on the current trends.

Now more than ever your reputation matters. Demographics, immigration, and the cyclical nature of the market suggest circumstances will eventually ripen, but those who adapt to the changes in the interim can prime themselves for success both in the present and future.

Shifting your focus from selling on rates, to selling on solutions will help solidify the trust your clients have in your expertise. And with that trust and positive reputation, you’ll be ready for everything ahead.

Because if there’s one thing we can be certain of, it’s that uncertainty is always temporary.