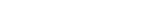

The Frontenac MIC by W.A. Robinson stands apart from other MICs. With our completely unique model, we may be the most conservative MIC in Canada today. For nearly 40 years, the Frontenac MIC has consistently yielded our investors an annual investment return that is typically between 5.0% – 6.5%.

And yet, we are still often asked: with rising inflation, global instability, and an expected real estate price correction, can the return drop to 4%? How about 2%? What combined factors would have to happen so that the Frontenac MIC provided no return at all (0%) in a calendar year?

Q: What would it take for Frontenac MIC to deliver a 0% annual return?

Our team ran the numbers. To get to zero – which to be clear, has never happened before – both of the following very unlikely scenarios would need to happen:

- Residential property values would need to fall by nearly 35%. If a correction in real estate takes place, the typical risk is that the value of the property will fall below the value of the mortgage given out by underwriter, in this case, Pillar Financial. That’s highly unlikely for Frontenac MIC, especially given that the weighted average is consistently in the 65%-70% range. Also, most real estate corrections impact major urban centres like Toronto and Vancouver; they have less impact on home prices in the smaller Ontario municipalities where we invest, like Kingston, Barrie, or Collingwood.

- More than 25% of borrowers would have to default on their mortgages. That’s a highly unlikely number since basic shelter is usually the last thing people put off for when times are tight. Currently 97% of borrowers pay off their mortgages without issue, with just 3% or less in default at any given time, and a fraction of those requiring Pillar to actually initiate the power of sale process because they are impaired. For context, the highest ever number of mortgage impairments (13%) occurred during the global financial crisis of 2008-2009; despite this, Frontenac returns still held up exceptionally well at 6.25% and 5.88% respectively.

It’s worth mentioning that the magnitude of the world events required to trigger both of these unlikely negative scenarios would also have a significant impact on all Canadian investment products, not just the Frontenac MIC.

A Nest Egg, Not a Goose Egg

Advisors recommend Frontenac MIC to clients because it is a conservative, consistent, and reliable alternative yield solution that aims for a typical annual return of between 5.0% – 6.5% (after fees) and has done so for decades. Our philosophy has always been capital preservation with a reasonable rate of return. And, unlike other financial products in the marketplace, we have never lost our investors’ money.

As of March 31, 2023

Our unique model gets these consistent, reliable returns for these six key reasons:

- The majority of the portfolio consists of first mortgages on the borrower’s principal residence. They are vested in keeping their homes.

- The maturities are short – typically 12 months or less – which enables us to quickly mirror and adapt to interest rate changes.

- The mortgages have reasonable LTV’s, typically 64-69% on new mortgages over the last four years.

- All mortgages are held on properties in Ontario, which offers the most favourable recourse laws towards the lenders among all Canadian provinces.

- The Frontenac MIC is run without leverage, which gives us better flexibility and control.

- And finally, experience & expertise. After nearly 40 years actively managing and adjusting for market trends and conditions, there may not be anyone that understands rural and small city lending in Ontario better than W.A. Robinson Asset Management and Pillar Financial.

Ready to learn more? Please contact W.A. Robinson’s Sales Team to learn more about the Frontenac MIC.

Download as PDF here.